In the last couple of weeks we have written articles about the after tax returns head start provided by investing in NZ shares relative to international shares, and PIE funds relative to non PIE funds.

Today we are delving deeper into the international non PIE funds. Because it is possible to alternate the method of calculating tax between FDR and CV method. This flexibility provides great benefit to the international investor during years where returns are less than 5%.

We are going to explore if that is enough benefit to close the gap between PIE and non PIE funds.

Note that for the data we are using the last 21 year returns (January 2004 to January 2025) for the NZX50 and the S & P 500 (U.S). The returns used are annualised in the hand returns (not average returns), and include dividends being reinvested.

To recall your memory from the last article, here are the after tax return differences between a PIE fund and an international non PIE fund using the FDR method only:

S & P 500 2004 to 2025 difference in after tax returns between a PIE fund and a non PIE fund at different tax rates

Assuming same funds with same fees, an investor on a 33% income tax rate investing in a PIE fund would be 0.26% per year better off.

But we are ignoring the flexibility of the non PIE investor being able to use the CV method for calculating international tax liability. If we include the ability to switch between FDR and CV methods, the non PIE investor experiences significantly better returns than the FDR only investor.

S & P 500 2004 to 2025 difference in after tax returns between an investor using just the FDR method vs an investor using both the FDR and CV method at different tax rates

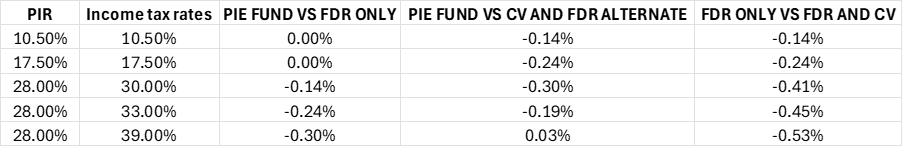

A summary of the differences between the three options (PIE fund, non PIE fund with FDR tax only, and non PIE fund with FDR AND CV tax):

S & P 500 2004 to 2025 difference in after tax returns between a PIE fund, a non PIE fund with FDR tax, and a non PIE fund with both FDR and CV tax at different tax rates

Assuming a 33% income tax rate, 0.45% per year better off by alternating between CV and FDR tax, relative to staying on FDR tax only.

An international non PIE fund that alternates between FDR and CV methods now better than an international PIE fund by 0.19% per year. Slightly worse off at the highest 39% tax rate though due to the PIE fund maximum tax rate of 28%.

In short, based on the last 21 year returns of the S & P 500, assuming a 33% income tax rate and 28% PIR tax rate, you would have the following head starts:

0.24% investing in an international PIE fund relative to a non PIE fund using FDR tax only

0.19% investing in an international non PIE fund using CV AND FDR tax relative to a PIE fund.

0.45% investing in an international non PIE fund using CV AND FDR tax relative to using FDR only.

These results are of course relevant on just one set of data. NZX50 and S & P 500 Jan 2004 to Jan 2025. If you take the data from a world fund rather than a US fund then the international returns may potentially be lower (or not), and if you change the timeframe, the results may differ too. Relatively speaking though, since we used a long timeframe, you would expect the head start differentials (percentage wise) to be fairly similar.

As seen a few articles back, you would have a 1.68% head start investing in a NZX50 fund relative to the S & P 500 fund, however the S & P 500 fund ended up 0.48% per year better off than the NZX50 fund thanks to much higher annualised returns. The minimal tax with NZ funds not enough (historically speaking) to make up for the poorer performance of the funds.

I am only providing the data for the head starts provided by each option. It is up to you where you go from there. It is one thing to look at returns only, but there is plenty more to consider when deciding on funds and an investment vehicle for your money.

Other considerations may include:

Differences in funds available

Fee differences

Differences in ease of use

Differences in how you manage tax. Is it managed on your behalf? Do you have to do it all yourself? Will you receive assistance? Will there be extra cost and administrative hassle?

Trustworthiness of fund managers

Once considering the big picture, it is up to you to decide whether the differences in each of the options are worth the difference in after tax returns.

But all else being equal, there is some handy information discussed regarding the head starts you may need to overcome. For example, if you are deciding between an international PIE fund or an international non PIE fund alternating between FDR and CV, you may have a head start of around 0.45% per year investing in the latter. So, if you go for a PIE fund, you want to make sure the other considerations are worth the 0.45% difference. This assumes a 33% income tax rate, but use the tables above for your own numbers.

As an adviser, I tend to recommend PIE funds for all my clients. Sure, some clients may be better off from a returns perspective swapping between FDR and CV tax each year, but they will be worse off in terms of time and mental bandwidth. My clients are all busy people who are trying to build their best lives possible. The best thing for them is to spend as little time on their finances as possible so they can live their best lives.

Not only the time and mental bandwidth savings, but clients who focus less on their investments tend to do less tinkering, which tends to lead to better returns anyway. The more active an investor you are, the more likely you are to do worse than someone who is less active. I am a big believer of focusing less on investments and not letting your behaviours get in the way.

That is why I tend to recommend PIE funds not just for my clients, but also for myself. Time with my young kids is scarce and I want to be in the moment with them. Not adding extra administration (and temptations) to my life. There is a real cost to trying to optimise everything.

But this is just my thought process. Yours may be completely different. For example, if you are young with no kids and can trust yourself, you may have the time, energy and willpower to save a few percentage points.

At the end of the day, investing is very personal.

I just hope that the data helps with your decision making process.

For more on FDR and CF FIF tax, have a look at this resource page.

If you need an investment plan or recommendations, then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here