I see a lot of investors writing off the InvestNow Foundation Series funds because of the 0.5% buy and sell fees. I understand the sentiment. We are often told that 0.5% or more in fees is quite a lot to pay and we should be looking for funds with lower than 0.4% fees.

But buy and sell fees do not take as big a toll on your investment balance as the management fees. And the funds in question have management fees as low as 0.06%.

Why this matters is that for most people, your investment balance is higher than the amount you buy or sell. So it’s much better having the low percentage on higher amounts and the higher percentage on lower amounts.

We will run through a few examples to show what I mean.

We will use the Foundation Series world fund as the example. 0.06% management fees and 0.5% buy and sell fees. We will compare it to a generic low cost fund that charges 0.3% fees (no buy and sell fees).

Example one: The buy and hold investor

This will typically be someone who spends as much as they earn, but has come across a lump sum of money to invest. So we will assume $300,000 to invest, but nothing thereafter. Assumed 7% returns over 20 years.

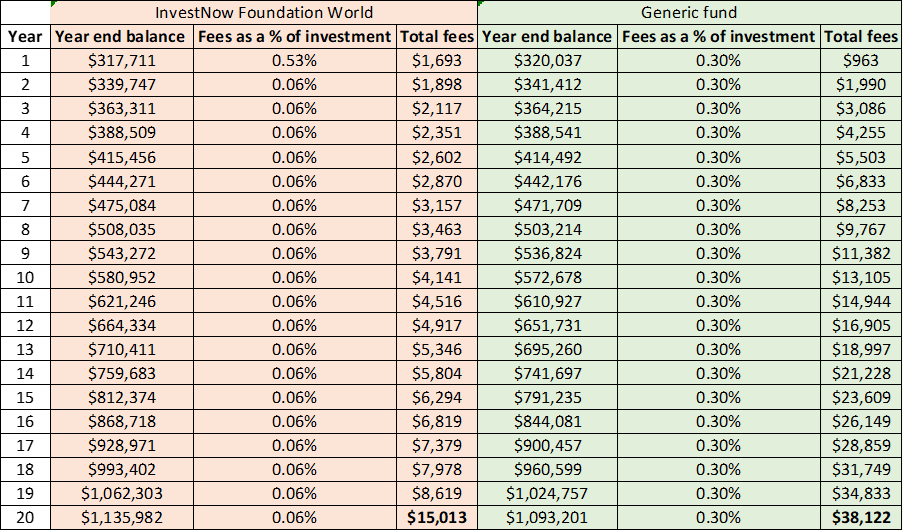

20 year difference in returns between the InvestNow Foundation Series world fund and a 0.3% management fee fund for a buy and hold investor

For the InvestNow fund, the year end balance assumes you sell your investments. After all, the value of your investment is what you would receive if you sold up. For the purposes of this exercise though, the total fees assumes you don’t sell until year 20 in this example of the buy and hold investor. Hence the jump in fees from year 19 to year 20.

$23,000 less paid in fees for the InvestNow fund compared to a fund that charges 0.3% per dollar invested. This includes InvestNow 0.5% buy fee at year one and sell fee at year 20.

The InvestNow investor, even with the 0.5% buy fee, is better off in just year two in this example, with total fees of less than the generic fund. Over $40,000 better off after 20 years.

To be equal with the InvestNow fund, the generic fund would need fees of 0.1% or less in this example. That is another way of saying the total InvestNow fees (including buy and sell) are the equivalent to 0.1% per year in this example.

That’s great, but you may be thinking this investor didn’t buy or sell much, therefore of course the InvestNow fund will be better.

So what about a more typical scenario of an investor that regularly buys an investment and has a lower opening balance?

Example two: The regular investor

This will be someone who doesn’t have any money to invest (starts from $0), but can invest a little each month. We will assume $1,000 a month to invest. Again assuming 7% returns for a 20 year period.

20 year difference in returns between the InvestNow Foundation Series world fund and a 0.3% management fee fund for a regular investor

$6,000 less fees with InvestNow and over $10,000 more invested. Despite buying every month with 0.5% fees for InvestNow.

You will note the annual fees as a percentage of investment is higher in this example, due to the buying. But as your investment balance grows, the Foundation Series fund becomes more cost effective after less than 3 years.

To be equal with the InvestNow fund, the generic fund would need fees of 0.13% or less in this example. That is another way of saying the total InvestNow fees are the equivalent to 0.13% per year in this example.

Example three: The retiree

Finally, we will take a look at someone who has saved up their nest egg and is now drawing down (selling) from their investments. Surely regularly selling from the InvestNow Foundation Series fund and incurring a 0.5% fee will be the killer blow for this fund.

We will assume the investor has $600,000 saved in this fund and is withdrawing $40,000 a year (plus inflation) for 20 years. Again assuming 7% returns.

20 year difference in returns between the InvestNow Foundation Series world fund and a 0.3% management fee fund for a investor drawing down from their portfolio

The Foundation Series fund still better off, even after years of a diminishing investment balance and regular selling. Lower investment balances mean the 0.06% management fee is not as effective as it is for higher investment balances.

The Foundation Series investor with almost $40,000 more than the generic fund investor. It is not until year 23 in this example that the generic fund investor paying 0.3% in fees would be better off. Once the investment balances are closer to $100,000.

If fees were 0.2% on the alternative fund it would still take 20 years for the generic fund investor to be better off. To be better off with the generic fund at 0.2% fees, you would need an investment balance of $230,000 or less with the assumed spend.

With the investor in retirement, this fund would not make sense if your spending was higher relative to your investment balance. In this example spend was 6.7% of the investment balance ($40,000/$600,000). The breakeven point where the generic fund fees are 0.2% seems to be spend of 17% or more of initial investment balance. If that is the case, then the generic fund will be better. At 0.3% fees, spend would need to be at least 35% of your investment balance to be better off.

Final thoughts

In the accumulation phase the InvestNow Foundation Series world fund is a great low cost index fund. Even with high buy and sell fees.

It is the total fees that should concern investors, so don’t get too scared off by buy and sell fees IF the management fees are low enough to offset. And in this case, the management fees are exceptionally low.

For the buy and hold investor you would need to find a fund that charges 0.1% or less to be better off, and that includes the Foundation Series 0.5% buy and sell fee.

For the regular investor, you would need to find a fund that charges 0.13% or less. A lot of this does depend on timeframe. We used 20 years. Over longer periods, the fee percentage required to beat the Foundation Series will likely need to decrease. The reason is as the investment balance grows over time, the management fee percentage from InvestNow works harder for you. With lower balances it isn’t quite as effective. Whereas, if your timeframe decreases, the fee percentage required to better InvestNow Foundation Series increases.

For example, the Simplicity global share fund charges just 0.15% in management fees. In many instances, the Simplicity investor and Foundation Series investor are pretty close from a fee perspective, although the Simplicity investor is often slightly better off over periods of 10 years. Not until the second decade does the Foundation Series investor go slightly ahead.

I have been attacked in the past for shilling products and with todays article I could understand if that was anyone’s thinking. But I can hand on heart say I have never been paid by any companies and I have no affiliation with any companies whatsoever. That is what allows me to remain independent. I just write about what I see fit. And today, after hearing many people write off this particular fund because of high buy and sell fees, I thought I would write out my thoughts to maybe challenge some of those thoughts.

At the end of the day it is total fees that matter. Run the numbers for your own situation before dismissing any options.

If you need an investment plan or recommendations, then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here