I commonly see bad advice handed out on social media for people looking for advice on their financial situations.

Typically, good advice requires a deep dive into the individual’s situation which you are not going to get on social media. Strangers on the internet are not going to give advice that is right for you.

One question I often see incorrectly answered for is on the NZ personal finance sub reddit. The poster will ask for advice on whether to keep or sell a rental property. Or maybe to buy a rental property or not.

This particular sub reddit is very pro shares and against property investment. There is a bias in the responses before the question is even asked. Additionally, how most in the sub reddit think about the answer is wrong.

The most common and most upvoted answers will look at the first year or the short term yield of the property and conclude that it is a bad idea to own a rental property from that short term snapshot. For example, if the annual rental income provided is $30,000 and the annual spend is $40,000 they will conclude the property loses $10,000 a year and if they invested in shares instead they would not only not lose money, but they would receive a return of say 6%.

Sure, if the property doesn’t gain in value then after a year or so they may likely be better off investing in shares. But there are five problems with this answer.

1/. Capital gains of the property are ignored. There may not be any in the short term, but over the long term there is a very good chance.

2/. Costs of owning property are highest in the early days. As the mortgage is paid down and/or income increases, the property expenses as a percentage of income decrease.

3/. Over time, rental income typically increases more than non mortgage expenses as rental income is often a higher number.

4/. Once the mortgage is paid off, the property investor not only has a property that increases in value, but also increasing cashflow as time goes on.

5/. There is no guarantee that the short to medium term return of shares will be positive, let alone average.

Should I buy or keep an investment property or invest?

I’ll run through an example, using one of my property calculators that you can find on the website.

We will assume a $700,000 property with a $560,000 30 year mortgage at a long term average of 5%. Rates, insurance and maintenance to cost 2% of the property value per year and increase annually with inflation. Inflation of 2.5%. Rental income of $35,000 increasing annually with inflation. An investor tax bracket of 33%. Will assume property gains of 3% per year.

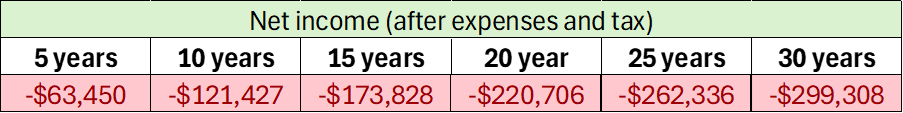

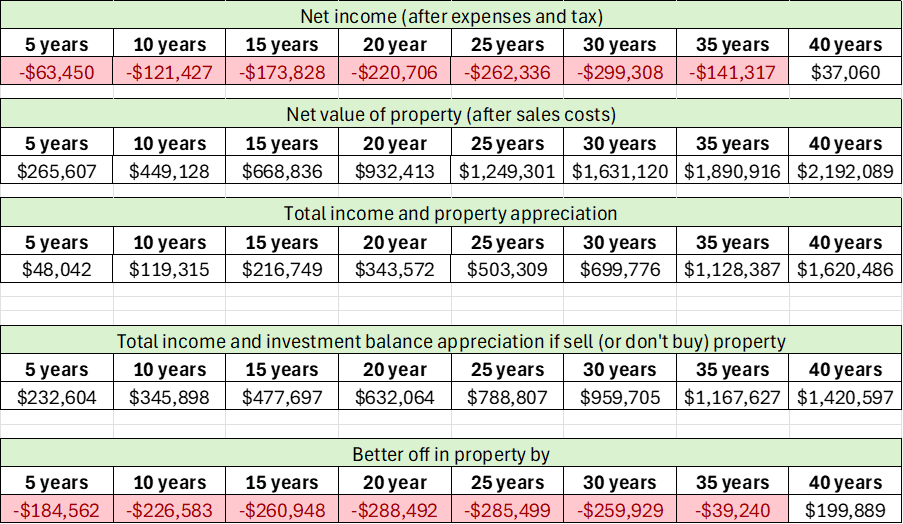

Net income from owning investment property over 30 years

Doesn’t look good for the property owner. Using almost $300,000 of their own cash to keep the rental property running over 30 years. But don’t forget we have the property capital gain too.

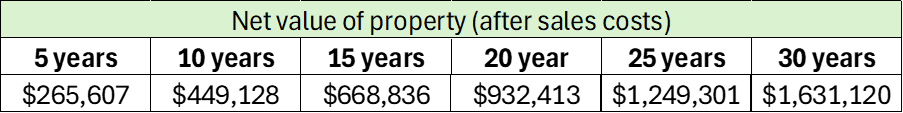

Investment property value over 30 years

That is how much the property investor would receive from selling the property after paying down the mortgage and any closing costs such as real estate commission. This includes the investors deposit returned too.

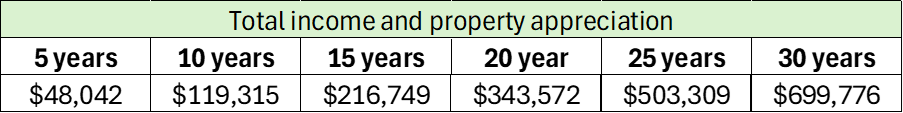

Combined income and property value over 30 years

This is how much they made once you add the cashflow and house price gains together. Almost $700,000 over 30 years.

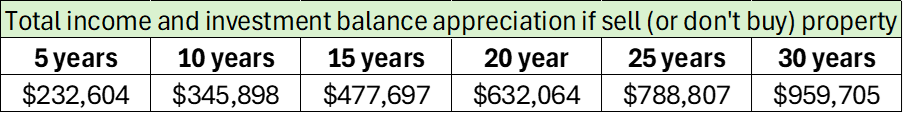

But how does that compare to investing? We will assume the investor invests in shares and has an average return of 4% per year after all costs, fees and taxes. We will also assume that the share investor is able to invest any money that the property investor needed to put into the property each year to keep it cashflow neutral.

Investment balance over 30 years if choose to invest outside of property instead

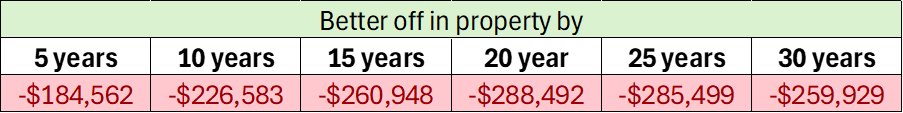

The share investor with almost $960,000 at year 30. Almost $260,000 better off than the property investor.

Net worth difference between property investor and non property investor over 30 years

So far looking good for the NZ personal finance reddit armchair experts.

But 30 years may not be a long enough timeframe for many investors. If we extend to 40 years, the property investor is ahead.

The difference between the property investor and non property investor over an extended 40 year timeframe

The property investor better off now by almost $200,000. You would expect the difference to be almost $500,000 at year 45 and $800,000 at year 50 in favour of the property investor.

You may also notice that I was quite hard on the property investor with the assumptions used. 3% annual property price gains is well below the historical average. 2% annual property costs is arguably high too. Many property investors will also buy a property that is losing less than $15,000 a year in cashflow like we assumed here.

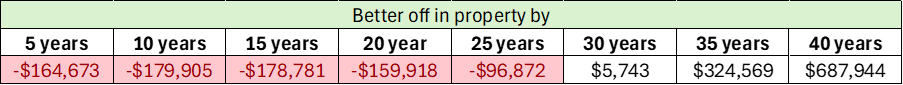

If we assume a small increase in house price gains to 3.5%, the property investor is better off in 30 years. And almost $700,000 better off after 40 years. And that is still with annual income of $15,000 less than annual spend. At least initially.

The difference between the property and non property investor over 40 years with house price gains of 3.5% (rather than 3%)

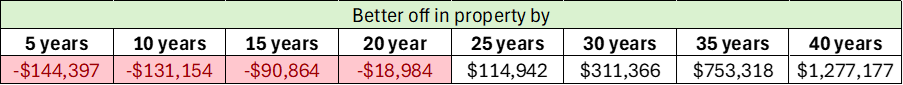

Or 4% house price gains and the property investor better off in around 21 years. $1.2 million better off after 40 years.

The difference between the property and non property investor over 40 years with house price gains of 4%

You could argue that 4% investment returns are a low assumption too. That equates to maybe around 6% pre tax pre fees for many people. But you need to account for sequence of returns too. Annualised return (what you actually receive) is often less than average investment returns because of the order in which you receive your share returns.

In the last 23 years house price gains have been around 6.5% per year and share price gains (S & P 500) around 7% after tax and fees. Take from that what you will but for those who think the investment return assumption of 4% relative to house price gains of 3% was too generous towards property, it was twice as less than the difference between the two over the last 23 years. Added to that is the fact we assumed minus $15,000 a year cashflow for the property investor, which is not the best purchase either.

Some property investors are able to buy in areas that benefit from house price gains more than in other parts of the country. Others are able to add value to the property more than the cost they put in such as through renovations, alterations, or subdivisions.

Final thoughts

The point here isn’t to say how wonderful property investing is. As you can see, it is wrong a lot of the time. Especially if you are investing for less than 30 years. The odds against property over shorter time periods. The odds in favour of property over longer time periods. The point is that one form of investing is not necessarily any worse or better than the other.

The best decision comes down to a combination of factors including your own numbers, your tolerance for risk, your timeframe, your current and future levels of diversification, your cashflow situation, and your goals.

No one on social media can help you with such a complex decision. Especially when most social media sites have an inherent bias towards either shares or property. It is hard to find someone that does not have an opinion either way.

This wasn’t meant to be advertorial for my services but it seems fitting to mention here that I am an independent Adviser that isn’t affiliated with shares or property. I can perform an independent review which is very rare. You will have to pay for the privilege but you know the results are tailored for you and you can be confident with your decision.

When the stakes are so high you don’t want to get it wrong, and free or biased advice often costs significantly more than paying for advice in the first place.

If you need help with any housing decisions, then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here