If you had the option to do your job as paid or non paid, pretty much everyone would choose paid.

This is the conundrum rife in the financial advice industry in New Zealand.

The most common financial adviser in New Zealand is paid by commission, either partially (fee based) or fully (commission based). So when given the option of getting paid or not, they will generally always recommend products to the client that provide an income for the adviser.

You can spin that any way you want, and I have seen many of such advisers claim they are working in the clients best interesst, but how can they be? If someone is paid for selling insurance policies then always in the back (or front) of their mind is “how can I sell more insurance?” Or if an adviser is paid by certain investment fund providers, then always in the back (or front) of their mind is “how can I recommend these funds before the funds that don’t pay any commission?”

Of course I would like to think most make recommendations that are with the clients best interests at heart. But what if the clients best interests are not what provides an income to such advisers?

Advisers with incentives will often give “good enough” advice and convince themselves it is the best advice. In other words, the best option for the client within the paid options available to the adviser.

But there are often better options not considered by such advisers.

I have had several clients come to me after receiving such advice that they had doubts about. The advisers made recommendations which made these clients a little uneasy and they came to me for a second opinion. After a quick review, it is clear that many have been sold products that don’t best suit their needs and goals.

The best option within an advisers paid options should not be considered best advice. It may be best available advice, but often not best.

Go to most financial advisers websites and trying to find transparent disclosures of conflict of interest is like trying to find a needle in a haystack. An advisers disclosure statement needs to be prominent on the website and it needs to disclose fees and conflicts of interest. Many do not. What are they hiding? Why are they not being open?

Because they want the appearance of independence at the low up front cost of commission based.

Let’s not beat around the bush. Independence costs. There is no payment from recommendations, so it is the client that needs to pay up front. But that’s it. One up front cost. No hidden costs.

On the face of it, it appears unattractive to most people. Why pay anyone from $2,000 to $10,000 for a financial plan when I can get one for less than $1,000?

The difference is the costs you can’t see.

As we know, low cost index funds provide the best chance of highest returns for an investor.

Let’s say an investment company pays an adviser a high commission for recommending a particular world fund to their clients. Let’s say this particular world fund charges clients a fee of 0.5% per dollar invested. The adviser may think win-win. I get to recommend a fairly low cost option to my client who wants a low cost index fund and I get paid handsomely. Thus fulfilling their duty as a financial adviser putting their clients needs first (loosely).

Although it may be a small win for the client, the client could be missing out on a bigger win.

InvestNow have a world fund that charges 0.07% per dollar invested. Plus an additional 0.5% buying and selling fee.

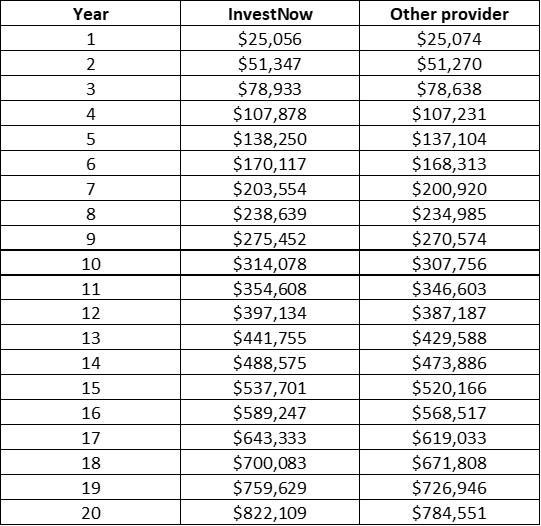

Assuming a $2,000 a month investment over 20 years, the difference may look like this:

The difference investment fund fees can make

A $40,000 cost to the client!

Now consider this is just one fund, and we didn’t even include inflation adjusted income. The difference in cost may be much larger.

Sometimes a small up front cost can cost much much more over the long run. Just because you can’t see the cost, doesn’t make it less so.

Up front fees are transparent and obvious and you know the value you are getting.

So before deciding on getting financial advice, just beware of low cost commission and fee based advisers. Their recommendations may be suitable for you. But could it be better? That is a question that would always be at the back of my mind.

Fee based is a trap many would be investors fall for. Sounds attractive doesn’t it? No mention of the word commission. But fee based still means some fee charged to the client and some commission. Not completely conflict free of incentives by any stretch.

If you want complete independence, what you want is a ‘fee only’ adviser.

You can be assured that a fee only independent adviser has no constraints on most suitable advice. There is no ‘best available’ advice. Only best advice. No upselling. No hidden fees. No inferior recommendations.

If I go to a doctor in a state and need some medicine, I don’t want the second or third best medicine. I want the best.

There is a cost for independent advice, but the cost of getting the best advice for you can be much less over the long run than getting ‘almost the best’ advice for you.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here