The other week, one of my friends got in touch with me regarding a reddit post that he got slaughtered over.

For anyone who doesn’t know, reddit is a website where you can discuss any topic you like. Each subject is called a sub reddit. For example, personal finance is one sub reddit that I used to frequent regularly before the commentators started turning nasty. I have stopped wasting my time there.

Anyway, my friend is also interested in personal finance and he commented on the attached post.

His comments have received over 30 downvotes and he asked me: “Am I wrong?”

I checked it out for him and have decided to turn it into a blog post!

Why your inflation rate matters

The post was about how low bank savings rates are at the moment. The discussion then turned to inflation eating all the returns of a savings account. To which my mate argued that his personal inflation rate is much lower than the national average inflation rate, so his returns are less impacted by inflation.

He was met by downvotes, insults, and patronizing. One of the reasons I left.

He has a very good point. What does the national inflation rate matter? It is your own personal inflation rate that matters.

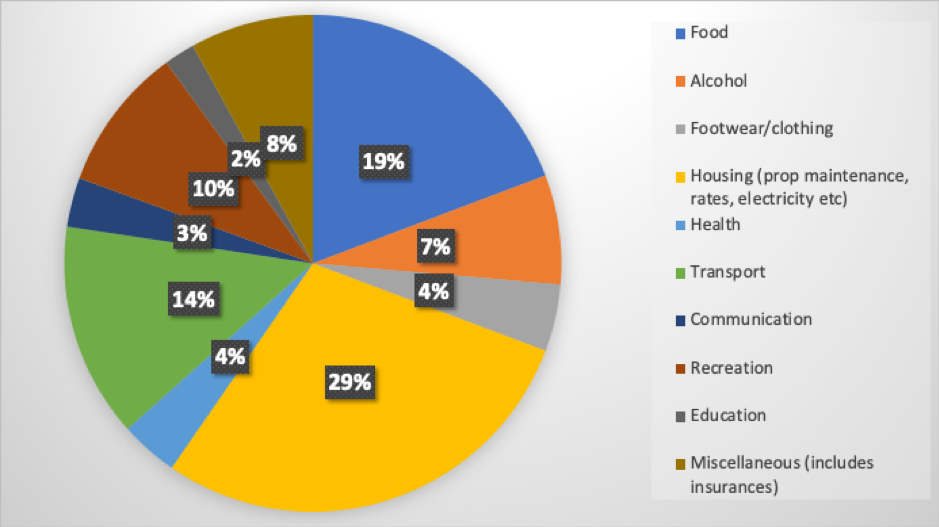

As at 2017, here is how the average New Zealander spends their money:

How the average New Zealander spends their money

Over the last 14 years, the average inflation rate has been 2%

Average historical inflation rate in New Zealand

Some categories tend to go up by more than 2%, such as education, health, housing, and food. Whereas others such as clothing, electronics, and transport increase at a rate lower than the average. This is an important distinction, because someone could have much lower food, housing and health costs as a proportion of their other expenses.

The other important thing worth considering is that many kiwis have mortgages. Mortgage interest expense is not linked to the CPI inflation statistics.

I asked my mate for his current expenses and found the following:

Personal inflation rate differs to national inflation rate

His personal inflation rate is 1.1%. Almost twice as small as the national average! This is because he has a mortgage interest expense that make up a high proportion of his otherwise low expenses.

This is extremely important in the context of investment and savings returns. If my mate has his savings in an account returning 2% after taxes, he still receives an inflation adjusted amount of 0.9% in the hand.

Someone who has a personal inflation rate that is the same as the national average and is in the same savings account, will not be making any money.

Turns out my friend was right, and reddit users have once again shown their negative herd mentality pouncing on anyone they don’t agree with. This also shows the importance of not believing everything you read, especially if users are not qualified to answer.

Once my friend’s mortgage is gone, chances are his personal inflation rate will be more closely aligned with the national average. But that will not be for a long time yet.

Our personal inflation rate is forever evolving too. If we sell a car, lose a mortgage, plant a food garden, or finish university, there will be quite a profound effect on our personal inflation rate.

What good is the national inflation rate for us individually? As my friend mentioned, we don’t spend the government’s money. We spend our own money and we all have unique circumstances. It is the inflation of our own spending we should be concerned with. Our personal inflation rate is not necessarily the same as the national inflation rate.

Conversely, someone who is heavily reliant on healthcare will likely have a personal inflation rate much higher than the national average. In such instances, investment returns become even more important, so not to erode the value of their money.

Can you work out your own personal inflation rate? How does it look? Chime in in the comments.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here