When it comes to investing, averages can be dangerous things.

We have discussed before how important the sequence of your returns are. Experience high returns early in your investing when you don’t have much money can leave you worse off than someone who experiences lower returns early in their investing, assuming the same average returns. Likewise, a retiree who receives poor returns at the beginning of their drawdown/retirement, will be much worse off than someone who receives the poor returns later on.

Why volatility of returns matters

Outside of sequence of returns, there is another aspect of returns that should be considered but doesn’t often get much airplay. That is volatility of returns. In other words, the range between the highest and lowest annual returns, and also the speed of those changes. One prime example of a highly volatile asset is Bitcoin.

Imagine a theoretical $10,000 investment that alternates every year between a 20% loss one year and a 40% gain the next year. That is an average gain of 10% a year.

We will assume these returns are after tax and fees and that we make no additional contributions.

I know this example is not realistic, but bear with me while I try to make a point!

After 20 years you would have $31,050. This is risk adjusted returns of just 5.9%. Significantly less than the 10% average.

Annual investment returns from a volatile asset

Now let’s assume another investment also provides returns of 10% a year, but it provides them in the form of a 5% loss one year, followed by a 25% gain the next year. Much lower highs, but also much lower lows.

Annual investment returns from a ‘safer’ asset

$55,760. Same average returns, but over $24,000 extra. Risk adjusted returns of around 9%.

This is nothing to do with the sequence of returns. Both examples have a poor year followed by a positive year. Both experience the same average annual return. But it is the volatility of each investment that differs. One investment experiencing much higher highs and higher lows than the other investment.

For comparison a straight 10% return looks like this:

10% investment returns over 20 years

I must admit this is an extreme example. When looking where to invest, you won’t experience such differences in volatility. And it is unlikely that you won’t continue to invest. Buying when asset prices are down will make the first two scenarios look a bit better, as will smaller ranges between high and low, and less frequent negative years than once every two years. But it does help to point out why it is so important to limit the downside and try to prevent your losses.

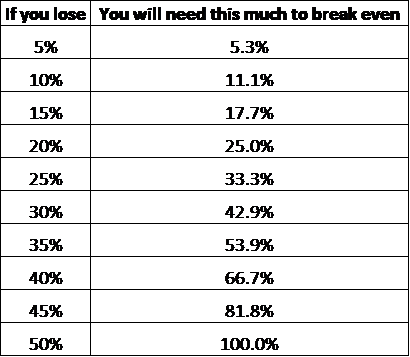

For a lot of people it isn’t very intuitive to think that you need higher returns to recover from losses. Many think “I lost 30% of my portfolio value, I need 30% in returns to get back to break even”. This couldn’t be further from the truth.

$10,000 with a 30% loss equals $7,000. A 30% gain back from $7,000 only equals $9,100. You would need around 43% in returns to recover from a 30% loss. More illustrations below:

Investment returns needed to break even from a loss

This is why risk adjusted returns are so important and why Warren Buffet says the most important rule of investing is to never lose money.

Of course there will be times where we all lose money. I’m looking at your 2022.

But there are some things we can do to limit losses.

How to reduce investment losses

Rebalancing

We can rebalance our assets periodically so we don’t overweight ourselves to a particular asset. Rebalancing is a fantastic way of reducing our risk without sacrificing a proportional amount of reward.

Diversification

We can invest in a wide range of seemingly uncorrelated assets so that hopefully some assets are having a good year when others are having a bad year.

Low fees

We can keep our investment fund fees low by investing in low cost index funds. High fees will eat into losses even further.

Know your investing timeframe

We can ensure that we are invested according to our time horizon and goals, so that we aren’t taking on too much risk. This greatly reduces the likelihood of larger losses, but also reduces the chances of you panic selling at a loss.

Final thoughts

There is no such thing as a free lunch when it comes to investing, but having a suitable asset allocation, low fees, remaining diversified, and periodic rebalancing is as close to a free lunch as you will get. Reduced risk without a substantial reduction in returns is a great deal. Just ensure that you don’t take on too little risk. Find that balance or your money won’t grow at all. Fear of losing money is going too far in the other direction.

Of course volatile assets can have a place in your portfolio, but it seems there is a common misconception that someone can lose money from an asset and return to break even just as easily. You can’t.

So just be careful when looking at average investment returns. That is not the number that will end up in your pocket. Volatility matters and the more volatile an investment, assuming the same average returns as another investment, will provide less in the pocket returns. So if you choose more volatile assets, you are going to want higher returns to compensate.

You can play around with your own personal numbers to see how much you could potentially lose with this free downloadable investment losses calculator.

If you need an investment plan or recommendations , then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here