There are many things in life that we want to try but we are afraid to. We will make all kinds of excuses as to why it can’t be done. Or we analyse and analyse until we can’t analyse no more and we have experienced information overload or paralysis by analysis.

This is a situation I see from many new investors. They know that index fund investing is a great way to go but they don’t know which provider to go with. They then analyse themselves silly to a point where they don’t understand what to do.

Which is such a crying shame. They have already made the great decision that index fund investing is a great way to go.

But they then start asking a lot more questions, such as:

Who invests the most ethically?

How much are the funds?

Do they allow minimal monthly investments?

Does their cost structure suit my method of contributions?

Can I reinvest dividends?

How am I taxed?

What will happen to my money if the provider closes office?

Should I pay international tax using the FDR or CV method?

Don’t get me wrong. These are important questions to consider. But my argument is you don’t need to know all this from the beginning.

Especially if not knowing this information is delaying, or even preventing you, from getting started.

You can learn these things along the way. When you are beginning, chances are you don’t have a large chunk of money to invest, so a few mistakes are fine. It won’t be costly. And definitely not as costly as not getting started at all. In fact, making mistakes when you don’t have much money in the game can prove extremely valuable.

Most of the index fund providers in New Zealand are very similar. Sure, some charge lower fees but the differences are not huge.

And definitely not as large as the difference between active and passive (index) funds.

By choosing passive you’ve made the most important decision already.

This logic can be applied to all areas of our lives.

We may not find the perfect house for our price range, but we can find one that is good enough.

We may not be the best at our jobs, but we are good enough.

You may not be in the best index fund for your situation, but you are in one that is good enough.

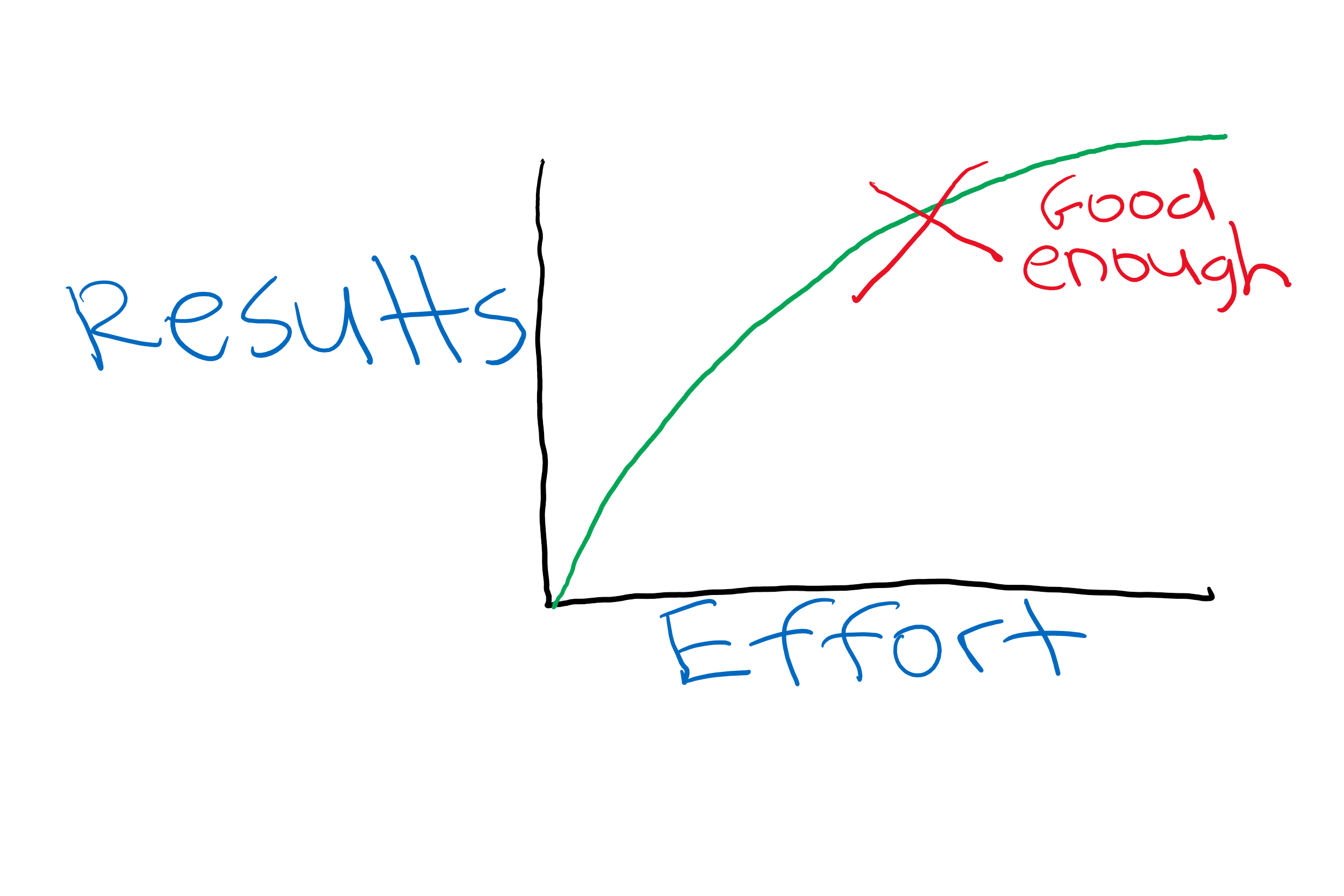

Small effort for large wins is much more effective than the incrementally larger effort for incrementally smaller wins, as can by seen in my award winning graphics.

Perfection not often worth the extra effort

We can always be better or have better, but at what time and price are you willing to sacrifice? Realise the effect that the search for perfection may be having on you and it may be time to realise that perfect is the enemy of good and could actually hindering your progress, not helping.

If you need an investment plan or recommendations , then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here