I provided an update last year on the affordability of NZ housing, and thought I would continue that trend in 2025.

We are in interesting times where unemployment is creeping up, but house prices and mortgage rates have been trending down. I suspect that houses are more affordable than they were a year ago, but lets dig into the data.

Are monthly mortgage payments affordable?

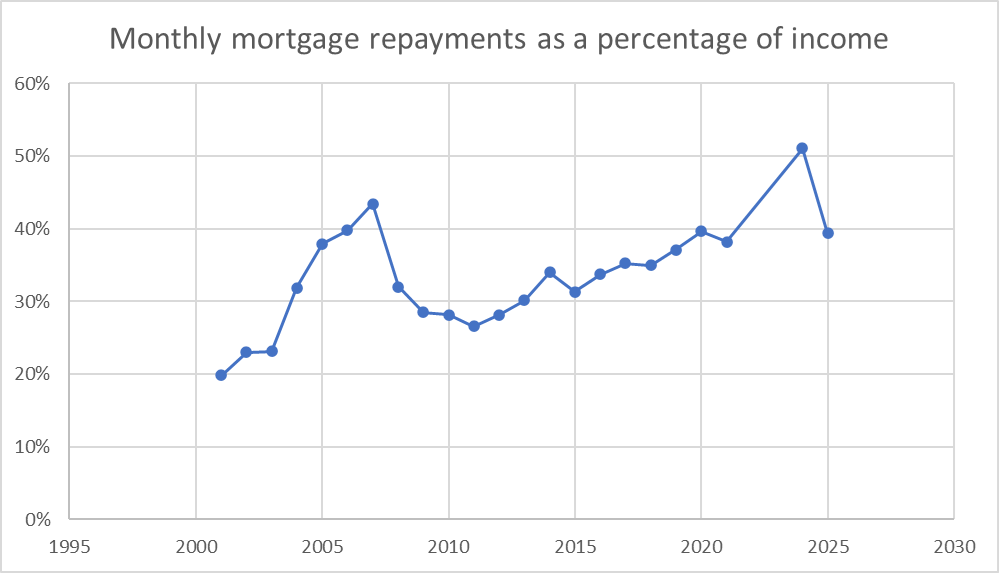

Monthly mortgage repayments as a percentage of income

Affordability is best measured by using monthly mortgage payments as a percentage of gross income.

This particular data assumes a 20% deposit on a 30 year mortgage.

The current data is:

Floating interest rate of 6.5%. This is a drop of 2.1 percentage points from just over one year ago!

Median nationwide house price of $770,000. This is an annual drop of $20,000 (or 2.5%).

Median household income of $118,660. 2025 median household income data has not been released to my knowledge so this assumes a 3% increase on 2024 which should be close to projections.

So with a 24% drop in mortgage rates, 2.5% drop in house prices, and 3% increase in income we see the median monthly mortgage payments drop to $3,894 a month, which is a drop of just over $1,000 a month from 2024. A drop from 51% of median household income to 39% of income.

The picture for buying a home looking much better than it was one year ago.

A mortgage of 39% of income is still high by historical standards but about on par with 2020-2021. This is also pre tax income too, so the percentage of in the hand income is much higher. Also don’t forget you still need to pay for other home ownership expenses such as rates, insurances, maintenance, and so on. Housing spend still taking up over 50% of after tax income for many people. But at least there has been some substantial relief in the last year. Also, many home owners are on lower interest rates than floating rates so that will help bring the per cent of income number down a little too.

Owning a home is one factor, but how about actually buying the damn thing? Is the situation better for how long it takes to save for a deposit?

How long does it take to save for a house deposit?

House deposit required as a percentage of income

The amount of pre tax income it takes to pay for a medium priced home ($770,000), with a 20% deposit ($154,000), on a medium household income ($118,660) has dropped from 137% to 130% in the last year.

The time it takes to save for a 20% deposit decreasing from around 11 years to 10 years.

Final thoughts

The nationwide data is definitely showing a significant improvement in affordability compared to a year ago for the average kiwi.

So why is the housing market still in so much of a limbo? Why aren’t home buyers racing out to the door to buy? Likely it is a combination of several things.

Better doesn’t necessarily mean good. Just because affordability is better than a year ago, housing spend as a percentage of income is still high by historical standards.

You also have rates and insurance increasing at a rate significantly greater than inflation over many parts of the country as councils make up for decades of underfunding and insurance companies localise policies.

Even though unemployment is only slightly up in the last year, there are still layers to this. Some areas of the country, such as Wellington, are experiencing much higher rates of unemployment and underemployment than the rest of the country. Some that are still employed have had their hours reduced. Those that are still employed are worried about job security. This translates to less confidence to spend, especially on big ticket items like houses.

Some people believe the economy is in turmoil for some time yet and are in no hurry to buy a house.

Rents are actually decreasing in some parts of the country making renting attractive by comparison.

I’m sure there are likely more reasons for not buying a house right now, but these are some from the top of my head.

It will be interesting to revisit things in a year to see where affordability stands. But it is definitely a lot better buying now than one year ago, as long as your employment is secure and you are in it for the long haul.

I have added a couple of housing affordability calculators and resources that you can view historical affordability statistics, as well as your own personal affordability levels. You can find them here.

If you need help with any financial decisions , then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here