If you are paying any interest, you will notice how much interest is being paid at the beginning of the mortgage and how little is actually going towards the mortgage principal.

With the following assumptions as an example:

$720,000 mortgage

30 years

6% interest rate

$180,000 deposit (25% equity)

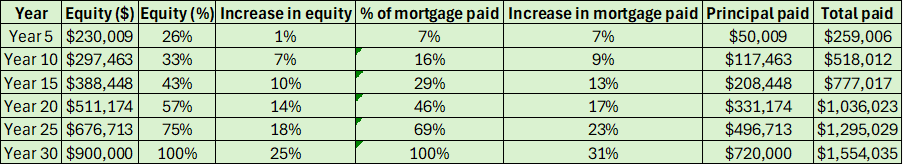

Mortgage repayments over 30 years on a $720,000 mortgage at 6% interest rates

We can see that in the first 5 years (17% of the mortgage duration) only 7% mortgage has been paid! And an increase in equity of just 1%! $259,000 spent in total and only $50,000 of that towards decreasing the mortgage. The rest towards interest.

Even after 15 years (50% of the mortgage term) only 18% has been added to equity out of a possible 75%. 50% of time has passed and less than one quarter of equity added.

Only 29% of the mortgage has been paid at the halfway point!

Yet in the last 5 years, more equity is added (25%) than in the first 15 years (18%) in total. 31% of the mortgage paid in the last 5 years which is 2% more than the first 15 years. One third the time.

This is the problem with upgrading house every 10 years. You keep repeating the first 10 years of a mortgage over and over. Never getting deep enough into the mortgage to make a real impact to your finances.

Of course we grow and evolve over time and we desire new houses that better fit our situation. Heck my family upgraded house by a significant amount this year. We knew the numbers but still went ahead with it because it suited our lives. But there have been significant financial downsides. We are now back to being at the beginning of a 30 year mortgage term where the majority of money is going to the bank.

Money is there to be spent at some stage. We can’t take money with us. We only get one life, so it is no good to save forever and only think about the finances. But it’s important to not ignore the finances either or you could find yourself surprised with your lack of progress or put into a position you would rather not be in.

As always, everything you do should be part of a larger plan where money is used deliberately and thoughtfully to help you live a life full of health, wealth and happiness.

I have a few mortgage calculators on the website already, but have added a new one called “Mortgage and equity changes over time” if you also want to look at changes to your equity levels over time and how much of your mortgage principal you are paying over time.

If you need help with any financial decisions , then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here