With house prices again in the headline news, out come all the feelings of FOMO from people not wanting to miss out on the capital gains party.

The old cliched line of house prices doubling every 10 years comes out and people are told that you can’t lose buying a house.

Recency bias is extremely dangerous. Just because house prices have increased so rapidly over the last 20 years it does not mean this will continue. In fact, by using numbers, I will show you that it can’t continue.

There are two factors that contribute towards how much a house costs over the term you own the house.

1/. The price you pay for the house

2/. The cost of the monthly mortgage

Higher interest rates will have a significant impact on higher house prices

The predominant reason that house prices have increased by so much over the last 20 years is because interest rates have been steadily declining.

From 2001 to 2019 the median house price increased from $178,000 to $629,000. Whereas the floating interest rate decreased from 7.6% to 5.7%, even getting as high as 10.1% in 2007. Mortgage repayments as a percentage of income varying between 21% and 42% depending on the year.

As soon as mortgage repayments get close to 45% of income, then housing will become even more unaffordable. Demand for housing will drop because people simply won’t be able to afford them. That is why I think the current rate of increase in house prices can’t continue.

Between 2001 and 2019, house prices increased by 253% and incomes by 63%.

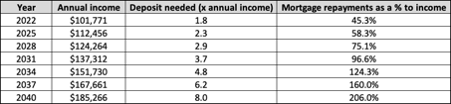

If house prices and incomes continue at the same rate for the next 18 years, then we get the affordability results below:

How affordable will houses be in the future?

8 times annual income needed just for a deposit in 2040. That is more than how much is currently needed for the whole mortgage, let alone the deposit. I am assuming a 20% deposit.

And mortgage repayments of 206%, over double, of one’s income is obviously not possible. This is pre tax income too, and doesn’t include other housing costs such as insurance, rates and maintenance. That will make housing take up an even greater percentage of income than in the above example.

This scenario assumes interest rates remain at 5% for the next 18 years too.

As seen above, house prices have only been able to increase so much over the last couple of decades due to declining interest rates. But now, there is not much further for rates to fall. Sure, they can possibly drop a little bit or remain the same. But over the next 18 years they are far more likely to increase at some stage.

So, as soon as interest rates go above 5%, the above table looks even more unrealistic.

The question then becomes how much will house prices increase in the next 18 year period? No one knows, but it definitely won’t be the 253% increase we have experienced over the last 18 years. Mortgage repayments of more than double income is obviously not possible.

Let’s assume that monthly mortgage payments of 45% of annual income is on the edge of affordability. If we make the assumption that affordability remains at 45% for the next 18 years, given the same rate of annual income inflation, we are far more likely to see the following assumptions for house prices:

How much higher can house prices go?

An 18-year increase of 82% in house prices. 4.5% per year.

This is a fair assumption as mortgage repayments as a percentage of income has never been above 45%, so it is pretty conservative.

If house prices were to increase any more than that, unless interest rates decrease to less than 5% on average over the next 18 years, then mortgage repayments as a percentage of median household income would increase to beyond 45%, which is getting towards the not going to happen category.

Historic house price increases are unlikely to continue

I hate to rain on anyone’s parade, but if I were planning for my retirement or for the next 20 years, I wouldn’t be banking on the same capital gains from housing as in recent times. In fact, I expect a drastic reduction in increases, closer to 4.5%, or less, per year on average.

When mortgage rates increase beyond 5%, I would expect the annual increase in house price over the next 20 years to be even less than 4.5%. This could be in the form of a sharp drop followed by a strong recovery, or it could be a slow gradual increase, or anywhere in between.

The point remains though that houses need to be affordable. Otherwise demand drops. The number one thing keeping high house prices sustainable is record low interest rates.

The sharp increase in house prices over the last two decades only made possible by declining interest rates. Rates have nowhere further to fall.

So unless incomes increase at quicker than 3.5% per year, then it seems we are in for modest increases in house prices over the next couple of decades.

Buying an undiversified asset like a house because of FOMO or because of stories about how good it has been for the last 20 years, is a terrible reason for paying too much, or using your house as a retirement strategy in the current climate. Banking on 9% a year or more in gains is foolish.

Making predictions is a mugs game, including mine. But the numbers are telling me to err on the side of conservativeness. House price increases are easy when interest rates are dropping. That is the key ingredient here. Now that this won’t continue to happen, I can’t see the same 20 year returns we have seen in recent times. In fact, not even close.

I don’t think ‘experts’ in the industry, like the one linked to in the second sentence, even run the numbers to see how their predictions are even possible.

As can be seen in people’s financial lives, it is hard to think long term. The average person struggles to find motivation to save for their future selves and retirement. It’s because short term thinking is so much easier. But just because something happened recently, like rapid house price increases, it does not mean this will continue. In fact, it is far more likely it won’t continue. Don’t make poor decisions for your future based on recent data or events. Take a wholistic approach.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here