To rent or buy a house is the million-dollar question – quite literally in many parts of the country.

Buying a home is probably going to be the single biggest purchase we ever make, so it needs to be well considered.

When buying a house, the most important financial consideration is how long do you intend to own the house for

The number one consideration we should make when looking at buying is to ask ourselves if we like the environment. Are we happy with the schools and amenities? Are we happy in our job? Are we near friends and family? In other words, if we were forced to live there for 15 years would we be happy, sad or in between? If our answer is happy then we are onto a winner.

This is a very important question because houses have substantial start up and closing costs. The financial commitment required to buy and sell a house is significant and can take 10-15 years before we see any financial benefit to owning. The problem is a lot of people can’t stay in one place for this long. Their families grow, they have a career or forced change, or they just want something better and want to move up the property ladder.

In most parts of New Zealand, homeowners move on average, every 7 years. Unless there is an exceptional spike in house prices, then 7 years is generally not long enough to get our money back unless we have made a substantial deposit, or if we are downsizing after we sell.

The key to financial wealth is longevity. The longer we can stay put in any asset class, the better our returns will be.

Our personal residence should not be looked at as an investment. Yes, it would be nice if it made us money, but it is a shelter first and foremost. If we want to make money from real estate then we should get a rental property or invest in real estate investment funds.

Buying a house is not just about the finances. There are also emotional factors to consider when deciding whether to buy or rent.

ADVANTAGES AND DISADVANTAGES of owning or renting a house

Advantages of renting or owning a house

Disadvantages of renting or owning a house

Common MYTH OF RENTING

I would just like to dispel the main negative I hear with regards to renting. It goes along the lines of “I don’t want to pay off someone else’s mortgage “or “I may as well be throwing money away”

These quotes that get thrown around are dangerous if listened to. They feed into the national psyche that buying a house is ALWAYS best. Many times it is, but often it is not.

As a renter, we may be contributing to someone’s mortgage, but essentially what we are paying for is a roof over our head. There is nothing wrong with that. Houses also have buying costs, selling costs, mortgage interest, repairs, maintenance, rates and insurance costs but people don’t tend to say they are throwing away dead money in this instance. Why not?

Example

Sarah buys a house for $800,000 with a $160,000 down payment. Her loan of $640,000 incurs an interest rate of 6% and a term of 30 years. Annual rates are $3,000. House insurance $3,000. Maintenance and repairs $8,000 total. Rates, Insurance and maintenance costs increase each year at an assumed rate of 4% 2%. The annual appreciation in property value is 4%. The cost of purchasing the house is $15,000 in bank, legal, building and valuation fees, transportation and moving costs, and new furnishings. The cost of selling the house is 3% of the sale price.

Jane decides to rent. The monthly rent for a property worth $800,000 is about $3,000. The annual rent increases at an assumed rate of 3% per year. Jane is a good saver and invests the $175,000 that went towards the purchase of Sarah’s house. The return on investments (after inflation) was 5% per annum (after inflation).

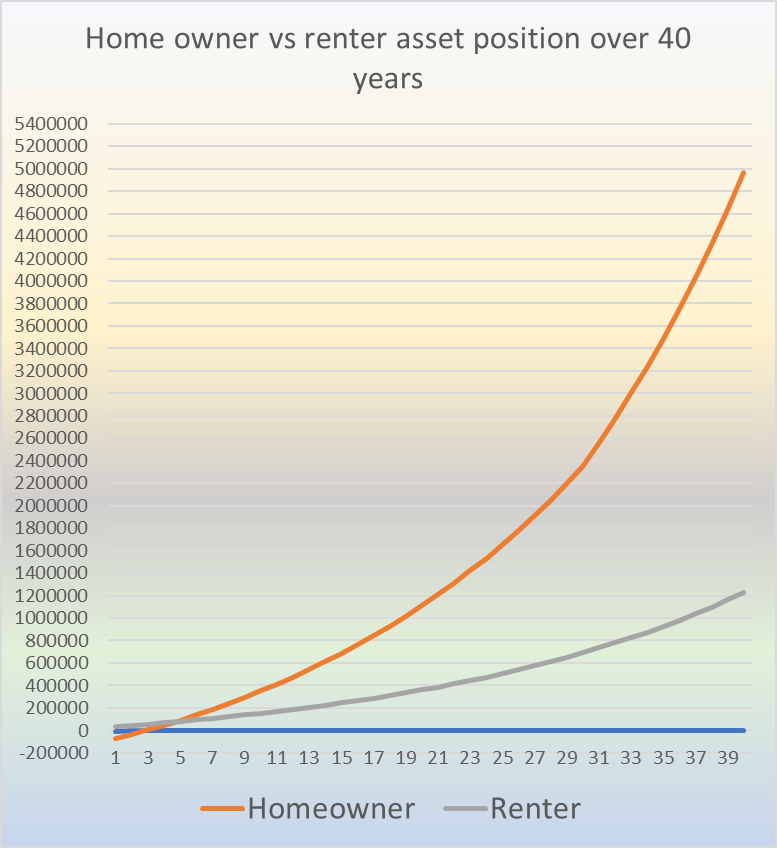

Asset comparison of buying a home vs renting

As you can see in this example, it will take Sarah the homeowner approximately 10 years to be better off than Jane the renter. But once she passes Jane, she races ahead at record speed. Going from being even after 10 years to almost $300,000 better off after 30 years. Then once the mortgage paid off and all that extra money is able to be invested instead of going towards housing, there is a huge advantage to the home owner, increasing exponentially from that point to end with a $1 million difference at year 40.

You can also see that if Sarah sold the house at the national average of 7 years she would be $33,000 worse off than Jane the renter. The buyer is much worse off early on because of the high buying and selling costs of owning a home. Also, the slow increase in home equity because the mortgage payments in the beginning contribute more to interest than to equity. Finally, because the renter has been able to save much more from the original $175,000 as it was not used as a down payment and purchase costs. This is the opportunity cost of buying instead of renting.

Whereas later on, the buyer is much better off because the down payment and purchase costs have had a longer period to be repaid. Towards the end of the mortgage, much more of the repayments are contributing to equity, and not so much interest. Whilst the owner capital gains are increasing at this stage, the renters accommodation is only getting more expensive as time goes on. Finally, when a mortgage is paid off, the home owner’s annual expenses are significantly less than the renter.

The big if here though is if the renter would save and invest the difference in costs. As we know, mortgages are a great form of forced savings. Will a renter have the same discipline when they don’t have that obligation?

These numbers are just one example. By playing around with the numbers depending on your own circumstance, you can see how much of an effect a simple change can make. If rental prices went up 5% a year instead of 3% then it would leave the homeowner $3.2 million better off after 40 years.

5% rental cost inflation

Or if house prices increased at 5% per annum instead of 3%, it would only take 5 years for the homeowner to be better off, and almost $4 million better off after 40 years.

5% house price inflation

Or what if we make some assumptions favouring the renter a bit more? Lets say 6% investment returns:

6% investment returns

Taking around 13 years for the homeowner to catch up to the renter, and remaining fairly even until year 30 when the mortgage is paid off. At that point, the homeowner streaking away.

FINAL THOUGHTS

Run your own numbers before you decide whether to rent or own. If you don’t know how, then pay a professional.

Don’t assume that buying a house is ALWAYS the best decision. Short term, the answer almost always favours renting. Long term almost always favours owning. Ask yourself how long do I expect to live here?

Don’t forget to consider the emotional aspects of both owning and renting. Not everything can be nicely calculated or plotted on a graph. If we value security then that will be a big factor against renting. If we want a house to leave to our loved ones then that is also a big tick to owning. Love to move around? Then renting will be preferable.

It is a huge decision that requires a significant amount of analysis and patience. Just because a bank is willing to lend us money it doesn’t mean we must take it. And we certainly do not have to borrow as much as we can afford. It is ok to save up for longer and pay even more than a 20% deposit. 20% does not have to be the automatic point at which we buy a home.

If we decide on renting, then we must be a good saver to benefit from that decision. Mortgages are great for homeowners because they act as a forced savings plan. If we are renting, we must show the same discipline as if we had a mortgage to have any chance of coming out ahead.

A home is for living, not investing. Don’t gamble on your personal shelter.

Don’t like the numbers used today? Or just want to run your own numbers? Lucky for you I have made this spreadsheet publicly available for you to run your own assumptions. Just change the variables in the purple cells and Bob’s your uncle.

If you need help with analysing the decision to buy a house or not, then get in touch and we may be able to help.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here

Comment below. Have you been torn between renting and buying? How did you make your decision?